For many small law firms, the thought of billing and invoicing often conjures images of tedious manual entry, missed revenue opportunities, and frustrating client disputes. In an era where efficiency and client satisfaction are paramount, relying on disconnected systems or antiquated processes is no longer sustainable. This comprehensive guide will illuminate the profound benefits of CRM integration for small law firm billing & invoicing, showcasing how a unified approach can transform your financial operations, enhance client relationships, and propel your practice toward unprecedented growth.

The Daily Grind: Billing Challenges Faced by Small Law Firms

The backbone of any successful law firm is its ability to effectively manage client relationships and accurately bill for services rendered. However, small law firms often grapple with a unique set of challenges that can hinder their financial stability and operational efficiency. From tracking every billable minute to ensuring timely payments, the process can feel like a labyrinth. Many firms rely on disparate systems – a spreadsheet for time tracking, a separate tool for client contact, and yet another for invoicing – creating data silos and increasing the risk of errors. This fragmented approach not only consumes valuable time that could be spent on legal work but also leads to delayed payments, inaccurate invoices, and, ultimately, a decline in profitability. Understanding these pain points is the first step toward appreciating how a truly integrated solution can offer a transformative path forward.

Consider the scenario where a legal professional spends hours meticulously entering billable hours into one system, then manually transfers that data to an accounting software to generate an invoice. This introduces multiple points of potential error, from transposing numbers incorrectly to forgetting to include a specific expense. Moreover, tracking the status of these invoices – whether they’ve been sent, viewed, or paid – often requires navigating between several applications, a process that is cumbersome and inefficient. When you factor in the complexity of managing different fee arrangements, retainer balances, and trust accounts, it becomes clear that a piecemeal approach to billing and invoicing can quickly become a significant administrative burden, diverting precious resources away from core legal services and client advocacy.

Unpacking CRM: More Than Just Client Management for Legal Practices

Client Relationship Management (CRM) systems are often perceived solely as tools for sales and marketing, designed to track leads and nurture customer relationships. While that’s certainly a core function, for a law firm, a CRM takes on a much broader, more critical role. It serves as the central hub for all client-centric information, from initial intake and communication logs to case progress and billing preferences. A robust CRM tailored for legal practices goes beyond mere contact management; it provides a comprehensive 360-degree view of each client, encompassing their entire journey with your firm. This includes details on their legal matters, communication history, documents exchanged, and, crucially, their financial interactions.

Think of your CRM as the institutional memory of your firm, a repository of every interaction and data point related to your clients. It helps ensure that everyone in the firm, from partners to paralegals, has access to consistent, up-to-date information, fostering better collaboration and informed decision-making. By centralizing client data, a CRM reduces the need to hunt for information across different folders or disparate systems, saving time and preventing miscommunication. When specifically designed with legal workflows in mind, a CRM can also manage tasks, deadlines, and court dates, transforming it into a vital practice management tool that underpins all aspects of your firm’s operations, making it an indispensable asset even before considering its integration capabilities with billing.

The Power of Synergy: Why Integrating CRM with Billing is Crucial

The true magic happens when your CRM system isn’t just a standalone database but is seamlessly connected with your billing and invoicing software. This integration isn’t merely a convenience; it’s a strategic imperative for small law firms looking to optimize their financial operations and client service. When these two critical functions are unified, data flows effortlessly between them, eliminating the need for manual data entry and reducing the likelihood of human error. Imagine time entries recorded directly within the CRM appearing automatically in an invoice draft, or client contact details from the CRM instantly populating an billing statement. This seamless exchange of information creates a single source of truth for all client-related financial data.

Without integration, firms face a constant struggle with data integrity and consistency. Client names might be misspelled in one system and correct in another, or a recent address change might not propagate to the billing department, leading to invoices being sent to the wrong location. This fragmentation not only wastes valuable administrative time but also risks damaging client relationships due to avoidable errors. An integrated solution, however, ensures that every piece of information relevant to a client’s billing is synchronized across platforms, providing a holistic and accurate financial picture. This synergy empowers small law firms to operate with greater precision, transparency, and responsiveness, directly contributing to improved cash flow and a healthier bottom line.

Streamlined Time Tracking & Expense Management for Law Firms

One of the most immediate and impactful benefits of CRM integration for small law firm billing & invoicing is the dramatic improvement in time tracking and expense management. For legal professionals, time is quite literally money, and every billable minute counts. Disjointed systems often lead to forgotten entries, imprecise records, or even the outright loss of billable hours, directly impacting the firm’s revenue. When your CRM is integrated with your billing system, time tracking becomes an intuitive part of your daily workflow. Lawyers can log their time directly within the client or matter record in the CRM as they work, ensuring that no billable second is overlooked and that entries are precise and detailed.

This integration extends beyond simple time capture to include the seamless management of expenses. Whether it’s court filing fees, research costs, or travel expenses, these outlays need to be accurately attributed to the correct client matter and included in their invoice. With an integrated system, expenses can be logged and categorized directly within the CRM, linked to specific cases, and automatically pulled into the billing process. This eliminates the need for separate spreadsheets or manual reconciliation, significantly reducing the chances of errors or missed expense recoveries. The ability to track both time and expenses comprehensively and link them directly to the billing cycle ensures that small law firms recover all their rightful charges, boosting their profitability and providing a transparent accounting to their clients.

Automating Invoice Generation and Delivery for Faster Payments

Manual invoice generation is a significant time sink for small law firms, often delaying the billing cycle and, consequently, payment collection. A core benefit of CRM integration for small law firm billing & invoicing is the profound automation it brings to the creation and dispatch of invoices. With all time entries, expenses, and client details already residing within the integrated system, generating an invoice transforms from a labor-intensive task into a matter of a few clicks. The system can automatically pull all relevant data for a specific client or matter, apply pre-set billing rates, and assemble a professional, itemized invoice ready for review and delivery.

Beyond creation, the integration also streamlines invoice delivery. Instead of printing and mailing, or manually attaching PDFs to emails, integrated systems often offer automated email delivery directly from the platform, complete with customizable templates and secure client portals. Some systems even include features to track when an invoice has been viewed by the client, providing valuable insights into the billing process. This automation significantly reduces the administrative burden on your staff, freeing them to focus on more strategic tasks. More importantly, faster invoice generation and delivery directly translate to a shorter accounts receivable cycle, improving your firm’s cash flow and ensuring that your hard-earned revenue is collected more promptly and efficiently.

Boosting Cash Flow: Enhanced Payment Processing & Collection

Improving cash flow is a critical objective for any small law firm, and CRM integration plays a pivotal role in achieving this through enhanced payment processing and collection capabilities. When your CRM is connected to your billing system, and potentially even to online payment gateways, the entire collection process becomes smoother and more efficient. Clients can often view their invoices directly through a secure client portal associated with the CRM and make payments electronically, reducing delays associated with traditional mail or bank transfers. This convenience for clients directly translates to faster payments for your firm.

Furthermore, integrated systems can automate payment reminders, sending polite nudges to clients with outstanding balances at predetermined intervals. This proactive approach to collections minimizes the need for manual follow-ups, which can be time-consuming and often uncomfortable for legal professionals. The system can also track payment statuses in real-time, providing an immediate overview of your firm’s financial health and identifying any potential issues before they escalate. By streamlining the payment process and automating collections, CRM integration directly addresses one of the biggest pain points for small law firms, ensuring a steady and predictable inflow of funds necessary for sustained operation and growth.

Achieving Data Harmony: Improved Client Data Accuracy & Consistency

One of the less visible but equally impactful benefits of CRM integration for small law firm billing & invoicing is the significant improvement in client data accuracy and consistency. In fragmented systems, it’s all too common for client information to be duplicated, outdated, or inconsistent across different platforms. An address change entered in one system might not be updated in another, leading to invoices being sent to the wrong location, or a client’s preferred contact method might be missed, causing communication breakdowns. These discrepancies not only create administrative headaches but can also erode client trust and lead to billing errors.

An integrated CRM and billing solution establishes a single source of truth for all client data. When information is updated in one part of the system, it automatically propagates across all linked modules, ensuring that billing, contact information, case details, and communication logs are always synchronized and accurate. This data harmony reduces the risk of errors in invoices, ensures that communications are directed appropriately, and provides a consistent client experience. For small law firms, this means less time spent reconciling disparate records and more confidence in the integrity of their client and financial data, leading to a more professional operation and fewer disputes arising from incorrect information.

Strategic Insights: Better Financial Reporting & Analytics

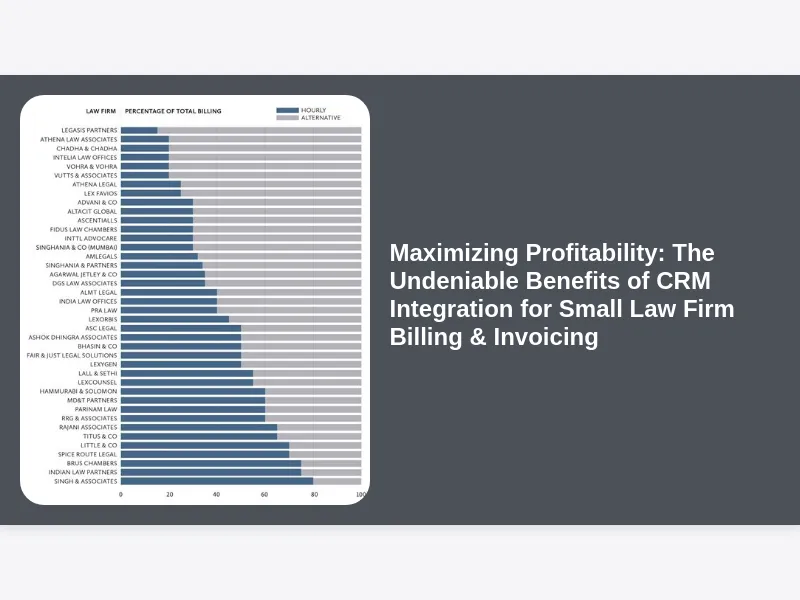

Beyond operational efficiencies, a significant long-term benefit of CRM integration for small law firm billing & invoicing lies in its capacity to generate superior financial reporting and analytics. When billing data is seamlessly connected with client and matter information within the CRM, the system can produce comprehensive reports that offer deep insights into your firm’s financial performance. Instead of just seeing raw numbers, you can analyze profitability by client, by practice area, or even by individual attorney. This level of granular detail is incredibly valuable for strategic decision-making.

Imagine being able to easily identify which types of cases are most profitable, which clients consistently pay on time, or where your firm might be losing revenue due to unbilled hours. These insights allow small law firms to optimize their service offerings, adjust their fee structures, and reallocate resources to maximize profitability. Furthermore, integrated systems can often generate reports on accounts receivable aging, helping firms prioritize collection efforts. By transforming raw financial data into actionable intelligence, CRM integration empowers law firms to make data-driven decisions that foster sustainable growth and improve overall financial health, moving beyond reactive problem-solving to proactive strategic planning.

Reducing Administrative Overhead & Operational Costs

For small law firms, every dollar saved on operational costs directly impacts the bottom line. One of the most tangible benefits of CRM integration for small law firm billing & invoicing is the significant reduction in administrative overhead. By automating time-consuming tasks such as data entry, invoice generation, and payment reminders, the need for manual intervention is drastically cut. This efficiency means that existing staff can handle a greater volume of work without being overwhelmed, or even that firms can avoid hiring additional administrative personnel as they grow. The time saved can then be reallocated to more productive, billable activities or strategic initiatives that drive firm growth.

Beyond labor costs, integration can also reduce expenses related to printing, mailing, and even the software subscriptions for multiple disparate systems. Consolidating functions into one integrated platform often proves more cost-effective in the long run than maintaining several independent solutions that require separate licenses, training, and troubleshooting. Furthermore, by minimizing billing errors and disputes, firms avoid the time and resources spent on rectifying mistakes, which can be a hidden but significant cost. Ultimately, by streamlining processes and improving accuracy, CRM integration directly contributes to a leaner, more efficient operation, allowing small law firms to boost their profitability by minimizing unnecessary expenditures and maximizing their team’s productivity.

Cultivating Loyalty: Enhanced Client Experience & Communication

In today’s competitive legal landscape, client experience is as crucial as legal expertise. A significant, though often underestimated, benefit of CRM integration for small law firm billing & invoicing is its profound positive impact on client satisfaction and communication. When billing processes are transparent, accurate, and easy to understand, clients feel more confident and trusting in their relationship with your firm. Integrated systems often provide clients with access to secure online portals where they can view their invoices, review payment history, and even make payments electronically. This level of transparency and convenience is highly valued by modern clients.

Furthermore, with all client communication and billing information centralized, your firm can communicate more effectively and proactively about financial matters. Automated payment reminders can be tailored to be polite and professional, rather than accusatory. Inquiries about invoices can be answered quickly and accurately because all relevant data is immediately accessible. By reducing billing disputes and making the payment process frictionless, firms can enhance their professional image and build stronger, more enduring client relationships. A smooth billing experience reflects positively on the entire firm, fostering client loyalty and encouraging referrals, which are vital for the sustained growth of any small law practice.

Preventing Disputes: Minimizing Billing Errors & Client Discrepancies

Billing disputes can be a major source of frustration for both law firms and their clients, often leading to strained relationships and delayed payments. A key benefit of CRM integration for small law firm billing & invoicing is its unparalleled ability to minimize these errors and discrepancies. The primary cause of billing disputes often stems from inaccurate timekeeping, forgotten expenses, or misapplied payments—all issues that are significantly mitigated by a unified system. When time entries are automatically linked to matters, expenses are accurately logged, and payments are reconciled in real-time, the likelihood of a client receiving an incorrect or confusing invoice plummles.

Moreover, the transparency offered by integrated systems, particularly those with client portals, allows clients to review their billable activities and charges in detail before the final invoice is even generated. This proactive approach allows for the resolution of any potential misunderstandings or questions early in the process, preventing them from escalating into full-blown disputes. By providing clear, itemized bills that clients can easily understand and verify, small law firms can foster greater trust and avoid the time-consuming and often reputation-damaging process of rectifying billing errors after the fact. This precision ensures that both parties are on the same page, preserving valuable client relationships and promoting a smoother, more predictable revenue stream.

Ensuring Compliance & Security in Legal Billing

For small law firms, adhering to strict regulatory compliance, particularly regarding financial transactions and client data, is not just good practice but a legal necessity. The benefits of CRM integration for small law firm billing & invoicing extend significantly into ensuring robust compliance and data security. Handling client financial information, trust accounts, and sensitive case details requires systems that meet stringent security standards to protect against data breaches and ensure ethical billing practices. Disparate systems, often relying on insecure manual transfers, inherently pose greater security risks and make it harder to maintain an auditable trail.

Integrated solutions, especially those designed for the legal industry, are built with these compliance requirements in mind. They often incorporate features like role-based access control, audit trails for all financial transactions, and encryption for sensitive data. Trust accounting rules, which are paramount for legal firms handling client funds, can be more easily managed and reconciled within an integrated platform, reducing the risk of commingling funds or other violations. Furthermore, by centralizing data in a secure, often cloud-based environment, firms can implement comprehensive backup and disaster recovery protocols, protecting against data loss. This comprehensive approach to security and compliance provides peace of mind, safeguarding both the firm’s reputation and its adherence to professional ethical standards.

Future-Proofing Your Practice: Scalability for Growing Law Firms

A critical consideration for any small law firm is its ability to scale operations as it grows without encountering bottlenecks or needing to completely overhaul its existing systems. A significant benefit of CRM integration for small law firm billing & invoicing is the inherent scalability it offers. As your client base expands, your case load increases, and your team grows, an integrated system can seamlessly accommodate the increased volume of data and transactions without a dip in performance or efficiency. Unlike manual processes or disjointed software solutions that buckle under pressure, an integrated platform is designed to handle growth.

This scalability means that your firm won’t hit a ceiling where administrative tasks become unmanageable as you add more attorneys or new practice areas. The automated workflows for billing, time tracking, and expense management can effortlessly process larger quantities of data, ensuring that your financial operations keep pace with your firm’s expansion. Implementing an integrated solution early on, even when your firm is still small, is a strategic investment that future-proofs your operations. It provides a robust and flexible foundation upon which you can build, allowing you to focus on acquiring new clients and delivering exceptional legal services, rather than being bogged down by the administrative complexities of a rapidly growing practice.

Making the Right Choice: Selecting an Integrated Solution for Your Firm

While the benefits of CRM integration for small law firm billing & invoicing are clear, selecting the right solution requires careful consideration. Not all integrated systems are created equal, and what works for a large enterprise might not be suitable for a small law firm. The key is to find a platform that is specifically designed for the legal industry, understanding its unique workflows, compliance requirements, and billing complexities. Look for solutions that offer robust time and expense tracking, flexible invoice generation (including various fee arrangements like hourly, flat fee, and contingency), and secure online payment options.

Consider the user interface and ease of adoption for your team. A system that is intuitive and easy to learn will minimize training time and encourage greater compliance from your attorneys and staff. Cloud-based solutions are often preferable for small firms due to their accessibility, lower upfront costs, and automatic updates. Investigate vendor reputation, customer support, and the availability of training resources. Don’t be swayed solely by price; consider the total cost of ownership, including potential efficiency gains and error reduction. A thorough evaluation process will ensure you select a solution that truly unlocks the full potential of integration for your firm’s financial health and operational efficiency.

Navigating the Transition: Overcoming Implementation Challenges

Even with all the clear benefits of CRM integration for small law firm billing & invoicing, the thought of implementing a new system can be daunting. Concerns about data migration, employee training, and potential disruption to daily operations are common. However, with proper planning and execution, these challenges can be effectively overcome. The first step is to involve your entire team in the process from the outset. Explain the reasons for the transition, highlight the benefits for them personally, and solicit their input to foster a sense of ownership.

Data migration is often a significant hurdle, but many reputable vendors offer migration services or provide clear guidelines to help ensure a smooth transfer of your existing client and billing data. Allocate sufficient time for training, and consider phased rollouts if necessary. Start with key users or a small pilot group before a full firm-wide implementation. Expect a temporary dip in productivity as your team adapts to the new system, but reassure them that these initial hurdles will lead to significant long-term gains. Effective change management, strong leadership support, and clear communication throughout the implementation phase are crucial to ensuring a successful transition and realizing the promised efficiencies and financial advantages of your new integrated solution.

The Undeniable ROI of CRM Integration for Legal Billing

Investing in an integrated CRM and billing solution represents a significant decision for any small law firm, but the return on investment (ROI) is often substantial and multifaceted. The benefits of CRM integration for small law firm billing & invoicing directly translate into tangible financial gains and operational improvements that far outweigh the initial outlay. Quantifiable benefits include increased billable hour capture, reduced administrative costs due to automation, faster payment cycles leading to improved cash flow, and a reduction in lost revenue from billing errors and disputes. Firms can often see a significant decrease in their accounts receivable aging and a boost in overall profitability.

Beyond the direct financial metrics, there are numerous intangible but equally valuable returns. These include enhanced client satisfaction, leading to greater client retention and referrals; improved data accuracy and compliance, reducing legal and ethical risks; and a more productive and less stressed workforce. The time saved on administrative tasks allows legal professionals to focus on their core competencies—practicing law and serving clients—which directly contributes to the firm’s reputation and growth. Ultimately, the ROI of CRM integration isn’t just about saving money; it’s about transforming your firm into a more efficient, profitable, and client-centric operation, laying a robust foundation for long-term success and competitiveness in the legal market.

Real-World Impact: General Success Stories from Integrated Legal Tech

While specific firm names are often confidential, the general impact of integrated legal tech solutions on small law firm billing and invoicing is consistently positive across the industry. Firms that have transitioned from fragmented systems to integrated CRM and billing platforms frequently report dramatic improvements in their financial health and operational efficiency. Many speak of regaining dozens of hours each month previously spent on manual data entry and reconciliation, allowing their staff to dedicate more time to client service and strategic firm development.

One common theme in these success stories is the transformation of cash flow. Firms often report a significant reduction in their accounts receivable aging, moving from chasing overdue invoices for months to receiving payments within weeks, thanks to automated reminders and convenient online payment options. Another recurring success is the reduction in billing disputes, with firms noting that clear, transparent invoicing fostered greater client trust and reduced the time spent resolving issues. These real-world impacts underscore that the benefits of CRM integration for small law firm billing & invoicing are not theoretical but are being realized by forward-thinking firms every day, leading to more profitable practices and happier clients.

Dispelling Doubts: Common Misconceptions About Legal Tech Integration

Despite the compelling benefits of CRM integration for small law firm billing & invoicing, several misconceptions often deter small law firms from embracing this transformative technology. One common myth is that integration is overly complex and requires significant IT expertise. While initial setup involves planning, modern cloud-based solutions are designed for user-friendliness, with intuitive interfaces and dedicated support from vendors, making them accessible even for firms with limited tech resources. Another misconception is that these systems are prohibitively expensive, tailored only for large firms. In reality, many integrated solutions offer flexible pricing models and scaled features specifically designed to meet the budget and needs of small practices.

Some attorneys also fear that automation will diminish the personal touch in client relationships, especially concerning billing. On the contrary, by freeing up time from administrative burdens, integrated systems allow legal professionals to dedicate more quality time to direct client interaction, focusing on their legal needs rather than chasing payments. Lastly, there’s a belief that existing manual systems, though cumbersome, are “good enough” and changing them isn’t worth the effort. This overlooks the significant hidden costs of inefficiency, errors, and lost revenue that manual processes incur. Dispelling these myths is crucial for small law firms to fully appreciate and act upon the immense potential that CRM and billing integration holds for their sustained success.

The Horizon: Future Trends in Legal Billing & CRM

The landscape of legal technology is constantly evolving, and future trends promise to further amplify the benefits of CRM integration for small law firm billing & invoicing. We are likely to see even deeper levels of automation, driven by artificial intelligence (AI) and machine learning (ML). Imagine AI-powered insights that not only identify your most profitable clients but also predict payment patterns, suggest optimal billing strategies, or even detect potential billing disputes before they arise. Chatbots integrated into client portals could handle basic billing inquiries, further streamlining client communication and reducing administrative load.

Blockchain technology may also emerge as a secure and transparent method for managing time entries and transactions, enhancing trust and immutability in billing records. Furthermore, the push towards greater interoperability between different legal tech solutions will make integration even more seamless, allowing firms to build bespoke ecosystems of tools that communicate effortlessly. As client expectations for digital convenience continue to rise, the ability to offer transparent, real-time access to billing information through advanced client portals will become a standard, not a luxury. Small law firms that embrace these evolving integrated solutions will be best positioned to thrive in an increasingly digital and client-centric legal world, ensuring their billing and invoicing processes remain at the cutting edge.

Empowering Your Firm’s Financial Health: The Integrated Advantage

In conclusion, the journey to a more profitable, efficient, and client-centric small law firm begins with embracing technological synergy. The myriad benefits of CRM integration for small law firm billing & invoicing are simply too compelling to ignore. From dramatically streamlining time tracking and automating invoice generation to enhancing cash flow, improving data accuracy, and fostering stronger client relationships, an integrated solution addresses the core financial and operational challenges that small practices frequently face. It transforms billing from a daunting administrative burden into a seamless, strategic process that supports your firm’s growth.

By reducing administrative overhead, minimizing costly errors, and providing invaluable financial insights, integrated systems empower small law firms to focus on what they do best: delivering exceptional legal services. In an increasingly competitive market, the ability to manage your finances with precision and transparency, while simultaneously enhancing the client experience, is not just an advantage—it’s a necessity. Investing in CRM integration for your billing and invoicing is not merely an upgrade; it’s a fundamental shift towards a more resilient, profitable, and future-ready law practice. Take the step towards integration, and unlock the full potential of your firm’s financial health and operational excellence.